MAE ZHENG – MARCH 21ST, 2019

The story of Fintech starts with the little changes happening in your life: you start using Venmo to split the check instead of awkwardly putting down multiple credit cards; the pizzeria around the corner replaces the bulky registers with fancy payment processing panels; loan applications take place on technology-enabled online platforms rather than inside bank branches. All these minor changes can be attributed to the rise of financial technology, or FinTech, which has revolutionized the financial services industry by offering more accessible services using technology.

Contrary to popular belief, the combination of technology and financial services is not a 21st century innovation. The FinTech industry started in the 1950s with the birth of the ATM and credit cards. With banks being the dominant provider of financial services, the FinTech industry was seen as an extension of traditional banking services, instead of a mainstream trend. In the 1990s, the rise of the Internet and the e-commerce business models allowed online retail websites to gradually replace the old phone-based retail merchandise model. Moreover, the rise of companies supporting institutional financial services also signaled the joining of technology and finance, with companies like Bloomberg supplying financial analytics software and Reuters reporting business and financial-related news. These improvements laid the groundworks for the financial services that we are used to now in 21st century. However, as a result of the maturing of capital markets and the growth of the economy, today’s FinTech industry extends way beyond the traditional realm of financial services from past decades, permeating into people’s daily lives.

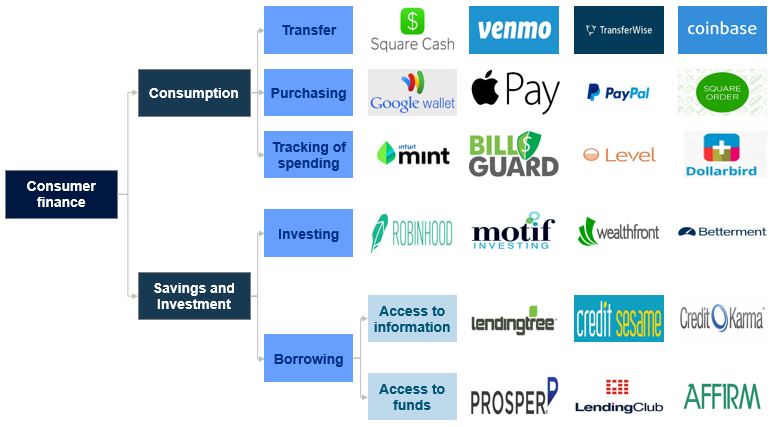

Today’s FinTech industry is tied to how users use money daily and what enterprises need. Within the consumer finance realm, various FinTech companies are addressing both the day-to-day spending and the long-term investment management need of consumers: products that assist daily transactions include PayPal, Square, and Apple Pay, while Mint and Intuit focus on managing personal finances. Meanwhile, stock investment software like Robinhood and consumer loan issuing platforms like LendingClub help with the investing needs of consumers. On the other side of the transactions, there has been an emergence of B2B (Business-to-Business) FinTech companies providing solutions that address various enterprise needs. To assist businesses in recording various transactions, an increasing number of companies such as ShopKeep and Erply have developed cloud-based point of sale (POS) systems to process retail orders and to help retailers record their financial data. Moreover, with the increasing enterprise demand for business and financial analytics, companies like Quickbooks are extending their services beyond just recording the transactions, and have started analyzing the data to provide useful conclusions for the business owners.

Indeed, we have come a long way since 1950s, but where is the FinTech industry heading? With the rise of cryptocurrency, big data, and the popularization of crowdfunding, we are witnessing a closer connection between financial services and more advanced technologies like Artificial Intelligence, Machine Learning, and data analytics. As technology and financial services become increasingly intertwined, there is also a noticeable increase in startups seeking to address the accelerating market needs. One of the most distinctive features of the growth in the industry has been the sheer number of FinTech startups that has emerged since 2000 and the large amount of funding that they have been receiving. According to FinTech Global, global FinTech investment has been increasingly steadily from 2014 to 2017, from $19.9 billion to $39.4 billion, at an annual growth rate of 18.5%. In the startup world, according to Crunchbase, more than $15.6 billion has been invested in seed, early, and late-stage U.S.-based FinTech startups, and we see a growth in dollar value of 25% from 2016 to 2017. More FinTech startups are maturing into unicorns (startups valued at over $1 billion), taking more seats in the unicorn club than any other industry, according to TechCrunch. With more companies basing their business models on the combination of technology and financial services populating today’s startup scenes and more disruptive technologies becoming commoditized, we may see even greater tangible changes in our daily lives.

Beyond the growth of FinTech industry and the new disruptive business models, it is also necessary to look at the potential risks that this booming industry may bring. One of the biggest concerns is the potential infringement of individual and enterprise data privacy. For most FinTech companies, because of the massive transactions data that is recorded and the highly classified nature of those financial data, any type of breach would lead to negative impacts on both the users and the companies. Leaking users’ financial data may lead to credit card fraud and identity theft. The companies, on the other hand, are likely to be subjected to fines and even more severe punishments. In 2016, the digital-payment company Dwolla was subject to a $100,000 penalty for “misrepresenting how it protected customer’s data” and was forced to better its practices to increase protection of user’s data. Globally, there has been growing concern regarding data privacy, exemplified by the implementation of General Data Protection Regulation in the European Union and the recent allegations against large technology companies such as Google and Facebook for improper uses of data. Under such climate, it is crucial for FinTech companies to ensure compliances with data privacy policies in order to decrease the risks of potential data breaching. To a lot of early-stage startups, the large amount of money and efforts devoted to ensuring proper compliance will greatly increase their costs, therefore posing another hindrance on the growth of FinTech startups.

Undoubtedly, the financial technology industry is a major force changing our world, as the combination of technology and financial services allow for more convenient lifestyles, and the innovative business models continue to influence other industries. Despite the robust growth and the bright industry prospects, it is also important for us to look at the risks that the industry growth will bring out, such as the potential risks for data privacy breach. FinTech remains a revolutionizing industry bettering our daily life, and I am excited to see where this industry will lead us in the future.

Featured Image: Minute Hack

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California, Berkeley in general.

Nice article!