JACOB FAJNOR – March 23rd, 2018

For years, fiscal conservatives have looked to cut and privatize Social Security in the United States, arguing that taxing working Americans causes leakages in the economy, stunting economic growth and job creation. As voters and economists, the debate over Social Security is prevalent in both our lives and discipline. But what if we look outside the United States? How would a system of intergenerational wealth transfers help or hinder developing nations in achieving economic prosperity?

First, we need to create a general model of how Social Security works. At an elemental level, Social Security operates on the model of intergenerational wealth transfers. When we are old the majority of us struggle to produce the same amount of output that we like to consume. In our prime working years, however, the majority of us will produce more than we can consume during a given time period. If we produce a durable good, we could save the excess and consume it in retirement to maintain a steady level of consumption throughout life. Many people think of savings in terms of money, but money is not a durable good as inflation makes savings and cash worth less as time goes on. Thus, for our model we will assume inflation is significant enough to drastically lower the purchasing power of lifetime savings to be used in old age.

So, are we doomed to penny pinching and poverty in old age? The answer to that question is no. We can prevent this dilemma with a system of intergenerational transfers of wealth. If goods are not durable over the time periods we defined, you cannot effectively carry surpluses from your productive years into your retired years; Thus, we should tax the excess in an individual’s working years that you cannot use, redistribute it to the current elderly, and then do the same with younger generations when they reach old age. Under a system of intergenerational transfers of wealth, assuming there is a constant 1 to 1 ratio of old to young people, we are able to have more stable consumption throughout the course of our lives.

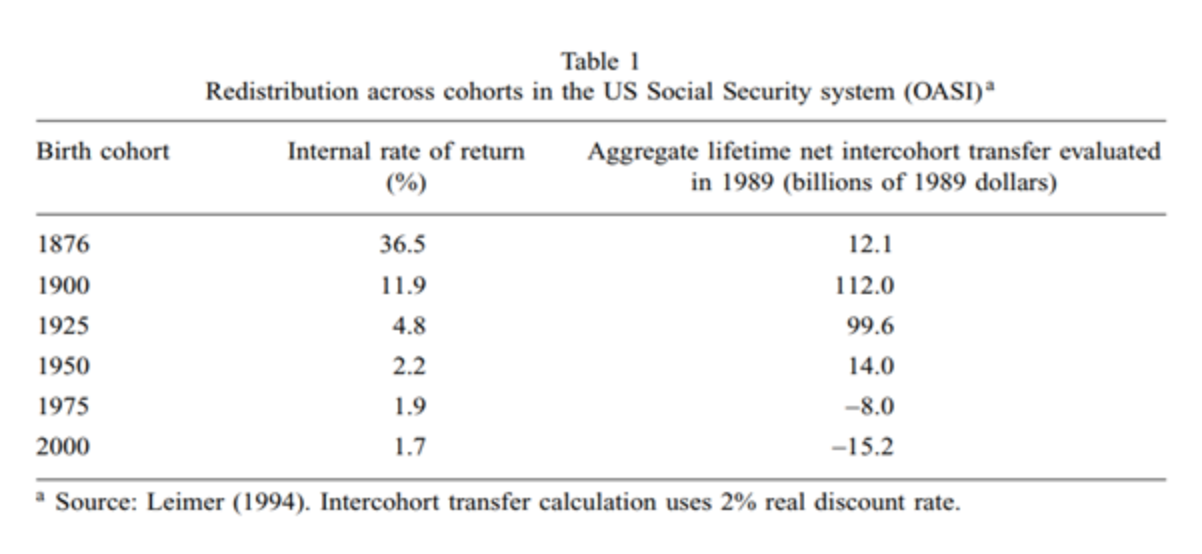

What incentive do people in their surplus production have to pay these taxes? Well, we can consider intergenerational transfers as a type of long term investment, as when workers retire they will be entitled to benefits. As it turns out, for the first few generations of an intergenerational transfer system see rates of return on their investment that are much higher than the risk-free rate (return on 30-year Treasury bond ~ 3% or lower).

Table 1 (adapted from slides by Prof. John Goldstein, Economic Demography, Econ 175, UC Berkeley Spring 2018).

While it appears that the benefits of the Social Security intergenerational wealth system have a lower rate of return for younger generations (the rate of return has dipped below the 30-year treasury), the social security program demonstrated positive returns for the first four generations who received its benefits. This initial high return rate could make intergenerational wealth transfers appealing to developing nations. Intergenerational transfer systems have greater and greater benefits with population growth, because there are a larger proportion of workers to retirees.

What are the implications of this effect? Since developing nations tend to have high population growth rates that are above the replacement population growth rate, there will always be more workers than retirees. More workers equates to lower income taxes since the same benefit packages can be provided to retirees with less taxation or the benefits can grow larger as time goes on. As lifetime consumption increases, we increase the consumption portion of the aggregate demand function, raising a nation’s GDP, standard of living and unemployment as more economic output equals more jobs if we assume no change in productivity. Therefore, we see intergenerational wealth transfer programs as a way to promote growth in developing nations.

Featured Image Source: Kiplinger

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of The Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California at Berkeley in general.

How do you compensate for the % of taxes that would be skimmed by corrupt third world governments?