ANSHIKA CHADHA – MARCH 21ST 2023

EDITOR: DANIEL LOPEZ-OROZCO

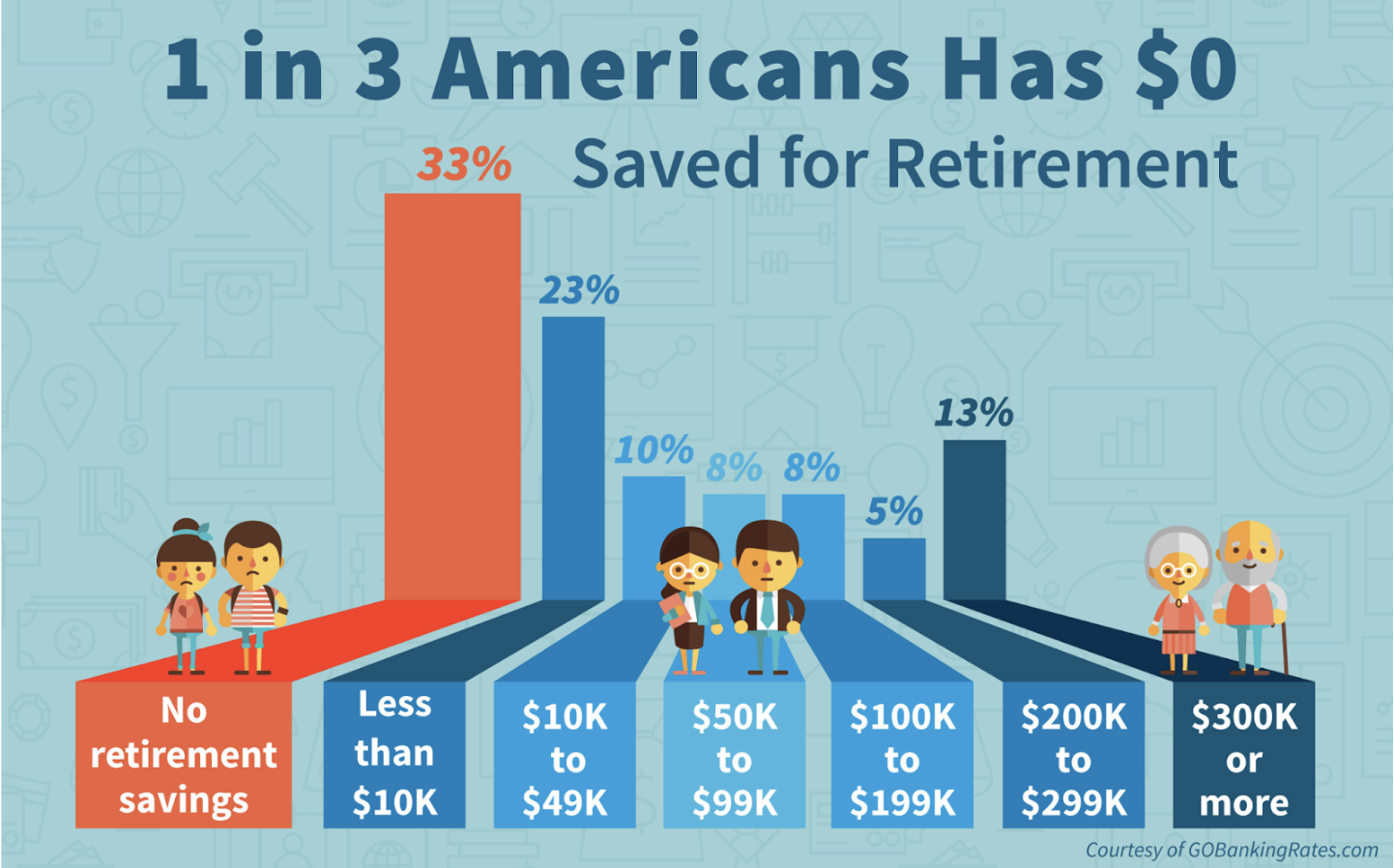

Saving money is challenging for many people. Despite their best intentions, people often struggle to build savings due to psychological and behavioral barriers. Behavioral economics has emerged as a field that provides insights into why people behave the way they do and how to nudge them toward better financial habits. In this article, I examine and delve deeper into the latest research on behavioral economics.

A General Overview

There are seven main factors affecting public perception and the habit of saving.

The Power of Small Wins

Saving money can be overwhelming, but breaking down larger savings goals into smaller, more achievable ones can help build momentum and motivation over time. According to research by Stephen Wendel, small wins can have a big impact on behavior. Celebrating each small win can help maintain motivation and focus on long-term savings goals.¹

The Role of Social Norms in Saving Behavior

Social norms play a significant role in shaping individual behavior. A study found that exposure to social cues that encourage saving can significantly increase savings rates. The study also found that peer influence and social pressure can positively influence saving behavior. For instance, participants who were shown a message highlighting the number of people who had saved money, as well as a message indicating that saving was a social norm, were more likely to increase their savings rate.

The Psychology of Scarcity and Its Impact on Saving

Scarcity, or the experience of having limited resources, can profoundly impact decision-making. A study by Mullainathan and Shafir found that people who experience scarcity tend to focus on short-term needs, making it difficult to prioritize long-term goals such as saving. Strategies that address scarcity and prioritize savings, such as emergency funds, can help reduce the impact of scarcity on saving behavior.

The Influence of Financial Education on Saving Behavior

Financial education is an important tool for improving financial decision-making. A study by Bernheim found that financial education can significantly increase saving behavior. Financial education can improve financial literacy, leading to better decision-making and more effective financial planning.

The Impact of Decision Fatigue on Saving

Making too many financial decisions can lead to decision fatigue, which can make it difficult to make good decisions about saving. A study by Baumeister and Tierney found that willpower is a finite resource that can be depleted by decision-making. Strategies that simplify financial decision-making, such as automating savings, can help reduce decision fatigue and improve saving behavior.

The Role of Incentives in Saving Behavior

Incentives can play an important role in motivating saving behavior. A study by Beshears found that framing savings as a loss, rather than a gain, can increase savings rates. This framing can tap into the human tendency to avoid losses, motivating individuals to save more.

The Impact of Economic Policies on Saving Behavior

Economic policies can have a significant impact on saving behavior. For example, a study by Baker (2020) found that most stimulus payments in the United States during the COVID-19 pandemic were saved or used to pay down debt. This suggests that economic policies that provide a financial cushion can positively impact saving behavior.

Micro-investment: less is more

The traditional view of saving often involves setting aside large sums of money for future use. However, recent innovations in financial technology have made it easier than ever to engage in micro-investment or the practice of investing small amounts of money over time. Microinvestment platforms like Acorns and Stash have gained popularity in recent years, particularly among younger investors who are interested in saving and investing but may not have large sums of money to invest upfront.²

Behavioral economics research suggests that micro-investment can be a powerful tool for promoting saving behavior. One reason for this is the concept of mental accounting. Mental accounting refers to the tendency of individuals to categorize their money into different mental accounts, such as savings, bills, and discretionary spending. By investing small amounts of money on a regular basis, individuals can create a mental account specifically for investments, which can make it easier to stick to a saving plan and avoid spending that money on other things.³

The Role of Micro Investment platforms

In addition, micro-investment platforms often use behavioral economics techniques like round-ups and automatic contributions to make saving more appealing and automatic. Round-ups, for example, involve rounding up everyday purchases to the nearest dollar and investing the difference. This technique can make saving feel painless and effortless, as individuals don’t have to think about setting aside money for investments. Similarly, automatic contributions can make it easier to save by automatically transferring a small amount of money from a checking account to an investment account on a regular basis.⁴

Loss aversion is the tendency for individuals to feel the pain of losses more strongly than the pleasure of gains. Micro Investment platforms can use loss aversion to encourage saving behavior by highlighting the potential losses that users may experience if they don’t save. For example, Acorns sends users a message if their account balance drops below a certain threshold, which can make users more motivated to continue saving.⁵

Advantages

Research has shown that micro-investment can be an effective way to promote long-term saving behavior. For example, a study of Acorns users found that the platform was successful in encouraging regular saving behavior, with 59% of users making regular investments and 80% of users reporting that the platform had helped them save money.⁶ Another study found that automatic contributions increased the likelihood of achieving long-term saving goals.⁷

Micro Investment can also be a way to promote financial literacy and engagement. By investing small amounts of money over time, individuals can learn about investing and the stock market in a low-stakes way. This can be particularly beneficial for younger investors who may lack experience with investing.

Final Thoughts

Microinvestment platforms have the potential to help individuals overcome common barriers to saving behavior and make progress toward their financial goals. However, it is important to note that like any investment, micro-investments come with inherent risks and individuals should carefully consider their personal financial situation and investment goals before making any investment decisions.

Overall, micro-investment has the potential to revolutionize the way individuals save and invest for their long-term financial well-being. By combining the convenience of technology with the principles of behavioral economics, micro-investment platforms can help individuals take small steps toward a better financial future.

Featured Image Source: CISION PR Newswire

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California, Berkeley in general.